According to the latest report from Yole Group, the market size of the semiconductor equipment industry is expected to reach $1 trillion by 2030. This growth is not only due to the natural expansion of the market, but also driven by key technologies and led by industry giants.

Drivers of key technologies

Growth of the server and automotive market

Server market: With the rapid development of cloud computing and data centers, the demand for the server market continues to grow. The server market is expected to be worth $390 billion by 2030, growing at an annual rate of more than 10%. This growth was driven by increased demand for high-performance computing and data storage.

Automotive market: The digital transformation of the automotive industry is driving the demand for semiconductor equipment. In particular, the development of electric vehicles and autonomous driving technology has made the automotive market an important growth point for the semiconductor equipment industry. The total value of the automotive market is expected to reach $112 billion by 2030.

The computing market continues to evolve

Computing market: The computing market is expected to be worth $150 billion by 2030, growing at an annual rate of 6%. This growth is mainly due to the development of emerging technologies such as artificial intelligence, machine learning, and big data, which have an increasing demand for computing power.

Steady growth of key components

DRAM, NAND, and processors: These key components are the main forces driving the growth of the semiconductor equipment industry. These modules are expected to grow at a steady rate of 7%-8% by 2030. As technology advances, the performance and efficiency of these components continue to improve to meet the market's demand for high-performance computing and storage.

Driven by technological innovation

Applied Materials' breakthrough in extreme ultraviolet (EUV) lithography technology has made smaller, more efficient chips possible.

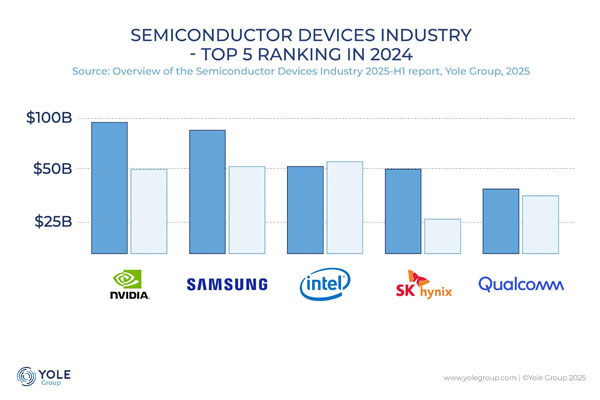

Figure: Top five suppliers in the semiconductor equipment industry

The performance of industry giants

NVIDIA

Industry Leader: NVIDIA tops the industry with $96 billion in semiconductor equipment revenue in 2024. Its leading position in graphics processing units (GPUs) and artificial intelligence chips has given it an important position in high-performance computing and autonomous driving technologies.

Technological innovation: NVIDIA continues to introduce high-performance GPUs and AI chips, driving technological advancements in the data center and automotive industries. Its innovations in the field of AI and autonomous driving have allowed it to stay ahead of the market competition.

TSMC

Foundry giants: TSMC is a close second in 2024 with $87 billion in foundry revenue. As the world's largest foundry, TSMC provides advanced manufacturing processes to many semiconductor companies, supporting the rapid growth of the industry.

Technical advantages: TSMC is a leader in advanced process technology and continues to promote innovation in chip manufacturing technology. Its breakthroughs in 5nm and 3nm process technologies have made it a significant player in the high-performance computing and mobile device markets.

Samsung

Integrated semiconductor giant: Samsung ranks third in 2024 with $83 billion in revenue. As an integrated equipment manufacturer (IDM), Samsung has significant market share in memory, processors, and foundry.

Diversification: Samsung's leading position in DRAM and NAND memory positions it in the data center and mobile device markets. At the same time, its rapid development in the field of wafer foundry also makes it competitive in the high-performance computing market.

Intel

Transformation of traditional giants: Intel ranks fourth in 2024 with $52 billion in revenue. As a traditional IDM giant, Intel has deep technical accumulation in the field of processors.

Strategic Adjustment: In the face of market competition and technological change, Intel is accelerating the innovation of its process technology and actively expanding its business in the field of data center and artificial intelligence. Its advances in 7nm and 5nm process technologies keep it competitive in the high-performance computing market.

Conclusion

The rapid development of the semiconductor equipment industry is driven by key technologies and led by industry giants. The growth of the server and automotive markets, the continued growth of the computing market, and the steady growth of key components have combined to drive the expansion of the industry. Giants such as NVIDIA, TSMC, Samsung, and Intel have maintained their leading position in the market through technological innovation and strategic layout. With the continuous advancement of technology and the increase in market demand, the semiconductor equipment industry is expected to reach a market size of $1 trillion by 2030 and continue to play an important role in the global economic and technological development.