In 2024, China's auto market will make history again, with production and sales exceeding 31 million units, further consolidating its leading position in the global auto industry. According to the statistics of the China Passenger Car Association, the cumulative retail sales of China's auto market in 2024 will be 22.894 million units, a year-on-year increase of 5.5%. Among them, the sales volume of new energy vehicles reached 10.899 million, and the market penetration rate exceeded 47.6%, which not only reflects the strong growth of the overall market, but also marks the deep penetration and rapid rise of new energy vehicles in China's auto market.

Major car companies performed well

In 2024, China's auto market will show a situation of "multi-point flowering", and the performance of major car companies is particularly prominent.

BYD is still the leader in the new energy vehicle market, with annual sales of 4.2721 million units, a year-on-year increase of 41.26%. Among them, BYD's sales of new energy vehicles exceeded 514,800 units in December, showing strong market demand and production capacity. BYD's cumulative sales of passenger cars were 4,250,400 units, a year-on-year increase of 41.07%.

Geely Automobile was not to be outdone, with annual sales reaching 2,176,600 units, a year-on-year increase of more than 32%. In particular, the annual sales of new energy vehicles reached 888,200 units, a year-on-year increase of 92%, which fully reflects Geely's layout and rapid growth in the field of new energy vehicles.

Chery Holdings' sales in 2024 will exceed 2.6 million units, a year-on-year increase of 38.4%. Among them, the sales of new energy vehicles are even more amazing, reaching 583,569 units, a year-on-year increase of 232.7%, which is the leader among mainstream car companies.

Leapmotor also performed well, with 293,724 units delivered, up 128% year-on-year. Leap's sales in December reached 42,517 units, exceeding 40,000 units for the second consecutive month, exceeding the sales target set at the beginning of the year.

In addition, Li Auto, HIMA, Zeekr Auto, NIO and other car companies have performed well, with continuous growth in delivery volume and market share, reflecting the rapid rise of China's own brands in the automotive industry.

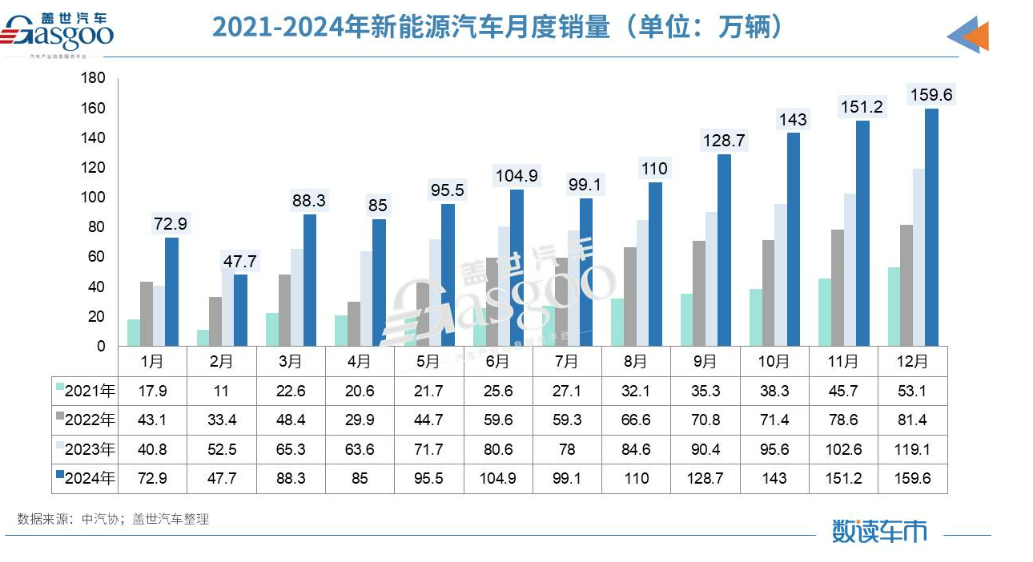

Figure: Monthly sales of new energy vehicles from 2021 to 2024 (unit: 10,000 units)

Market trends and future outlook

In 2024, China's auto market will show several major trends.

First of all, the new energy vehicle market is still the most eye-catching growth point. With the gradual deepening of the country's policy support for new energy vehicles, especially the rapid growth of sales in the second half of the year, the market penetration rate of new energy vehicles continues to rise. The state's replacement subsidies, scrapping subsidies and manufacturer discounts have greatly reduced the cost of car purchases, which has greatly stimulated consumers' desire to buy.

The export market is also a bright spot for China's auto market in 2024. Total exports for the year reached 4.791 million units, up 25% y/y. Among them, the export volume of new energy vehicles was 1.29 million units, accounting for nearly one-third of the total exports, demonstrating the strong competitiveness of China's new energy vehicles in the global market.

In terms of inventory, the inventory pressure of Chinese automakers will gradually ease in 2024, with the overall inventory falling by 340,000 units, accelerating the process of destocking and effectively controlling inventory risks.

For the future, the growth of China's auto market will continue in 2024, and the domestic passenger car market is expected to grow by about 1.8%. In particular, new energy vehicles represented by extended range and plug-in hybrid will continue to be the main driving force for market growth. According to the forecast of Gasgoo Automotive Research Institute, by 2030, the market share of domestic independent brands will reach more than 70%.

Challenges and industry reshuffle

Although China's auto market has made remarkable achievements in terms of production, sales and market penetration, it also faces many challenges.

First of all, price war is still the main feature of market competition. Especially in the field of new energy vehicles, electric vehicle manufacturers have reduced costs through large-scale production, which has further reduced prices. This trend can be a heavy blow to some of the weaker businesses.

In addition, the market is becoming more and more competitive. As car companies launch new models and increase investment in innovation, the pricing dominance of leading car companies is gradually controlled, resulting in a certain limit on the growth space of the overall market.

The industry reshuffle will continue to accelerate. As most new energy vehicle manufacturers are still in a loss-making state, some companies are facing slow transformation and financial pressure, and it is expected that some companies will withdraw from the market because they cannot adapt to market competition.

Gasgoo Automotive Research Institute predicts that China's auto exports will maintain steady growth in 2025. Specifically, with the gradual implementation of the EU market tariff policy, coupled with the severe pressure of carbon emission fines faced by traditional European car companies in 2025, the tariff cost of China's pure electric vehicles (BEVs) is expected to be effectively hedged through credit trading revenue, thereby promoting the strong growth of exports to Europe. At the same time, exports to Southeast Asia and Latin America will be further boosted as more Chinese automakers start operations in KD plants in these regions. In addition, there is still potential for export growth in the Middle East and CIS markets.