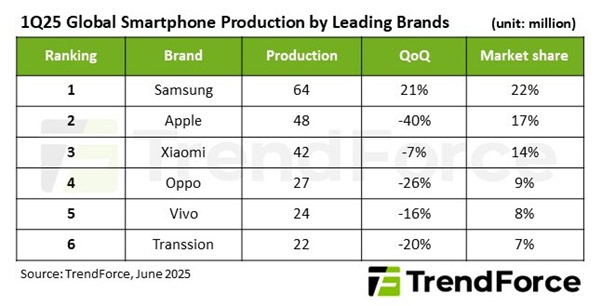

According to the latest report released by market research firm TrendForce, global smartphone production in the first quarter of 2025 will be 289 million units, down 3% from the same period last year. Despite the slight weakness in the overall market, the local market has outperformed and become the main engine of global shipment growth, driven by China's subsidy policies.

Samsung rebounded strongly and returned to the first place

Samsung's production reached 64 million units in the quarter, an increase of 21% quarter-on-quarter, and successfully regained the top spot in the world in terms of shipments from Apple, occupying 22% of the market share. This growth is mainly due to two factors: the deployment of production capacity for the launch of a new generation of flagship products, and the active expansion of overseas production capacity to hedge against the imminent new tariffs of the United States. In addition, Samsung's increasingly mature product line in mid-to-high-end models has further consolidated its market advantage.

Apple took a back seat to second place, with a significant decline in market share

Apple production was 48 million units, down 40% month-on-month. The main reason for the decline in shipments is that the previous generation of products is entering the end of their life cycle and new products have not yet been released. At the same time, because most Apple products are not covered by Chinese subsidies, they lose their price advantage in the domestic market, resulting in weakened competitiveness. While U.S. consumers bought ahead to circumvent potential tariffs and boosted sales in the short term, TrendForce believes that this type of "front-running" consumption will exert reverse pressure on overall demand in the following quarters.

Xiaomi is firmly in third place, and the ecological effect of the product has appeared

Xiaomi (including Redmi and Poco sub-brands) shipped nearly 42 million units this quarter, ranking third in the world. With a multi-layered product line covering entry-level to flagship, coupled with the positive effect of China's subsidy policy, Xiaomi's overall performance is solid. It is worth mentioning that its ecological strategy of "people-vehicle-home" integration has begun to take shape, and the synergies between smartphones, smart home and electric vehicle businesses are gradually emerging, enhancing brand stickiness and market recognition of high-end products.

Chart: Smartphone production reached 289 million units in the first quarter

OPPO and vivo: adjusting inventory to meet the challenge

OPPO (including OnePlus and Realme) produced 27 million units, down 26% month-on-month and 19% year-on-year. The main challenge is inventory adjustments, but the brand's expansion strategy continues in overseas emerging markets such as Europe and South America. In particular, Realme, with its fashionable design and high-cost performance, has quickly accumulated popularity among young consumers in Latin America.

vivo (including iQoo) ranked fifth with 24 million units. Benefiting from the deep cultivation of the Chinese market and the direct stimulation of subsidy policies, vivo achieved year-on-year growth. iQoo focuses on e-sports and performance users, successfully attracting young consumers and helping brands maintain their popularity.

Transsion is cold, and competition in emerging markets is intensifying

Transsion Holdings (including TECNO, Infinix, and itel) shipped about 22 million units in the quarter, down 20% quarter-on-quarter and 28% year-on-year. As its main markets are concentrated in Africa, South Asia and the Middle East, it has not benefited from Chinese subsidies. In addition, emerging markets had a large-scale inventory replenishment in early 2024, resulting in a high base for the same period this year. Coupled with the fact that competitors such as Honor and Realme have accelerated their layout in related markets, the pressure on Transsion has increased sharply.

Q2 outlook: Uncertainty persists and brands need to be nimble

TrendForce pointed out that while some regional policies remain supportive, global geopolitical turmoil, slowing economic growth, and cautious consumer spending have put the overall market at risk of stabilizing or even slightly downgrading in the second quarter. In the future, brand manufacturers will need to continue to pay attention to the policies and consumption dynamics of key markets (such as China, India, and Southeast Asia), and flexibly deploy supply chain and product strategies to respond to the changing market environment.