In 2023, the automotive industry also showed strong growth, but in 2024 the situation took a sharp turn for the worse, with S&P Global Mobility reporting a 1.6% decline in light vehicle production for the year. The reasons behind this are more complex: after the epidemic, the auto inventory is at a high level, and the large backlog of inventory makes the production power of car companies insufficient; The global economy is facing many challenges, with declining consumer purchasing power and a consequent decrease in demand for the automotive market; The government's reduction in subsidies for the purchase of electric vehicles has weakened consumers' incentive to buy electric vehicles; The complex supply chain of automobiles and the unstable supply of parts and components have also affected the normal production of automobiles.

However, in the long run, the outlook for the automotive chip industry is not bleak, and there are actually many positive factors.

The global economy is gradually recovering. Both the International Monetary Fund (IMF) and the World Bank predict that the global economy will grow steadily through 2025, with the World Bank projecting global economic growth to reach 2.7%. As the economy recovers, interest rates are also slowly falling. Although the possible tariff policy implemented by the United States has raised some concerns that it will lead to global inflation and make interest rates rise again, if interest rates can maintain a steady downward trend, consumers' purchasing power will be improved, which will stimulate the automobile consumer market, thereby indirectly promoting the development of the automotive chip industry.

The demand for automotive semiconductors is growing rapidly. The widespread use of advanced driver assistance systems (ADAS) and the increasing sophistication of in-vehicle user experience (UX) functions have led to a significant increase in the use of automotive semiconductors. According to S&P Global Mobility, the average semiconductor content value per vehicle will grow from about $1,000 today to more than $1,400 by 2030, an increase of up to 40%. Among them, the development of ADAS is particularly significant, with a report by the Traffic Safety Analysis and Research Cooperative in the United States showing that 10 of the 14 ADAS functions have a market penetration rate of more than 50%. For example, features such as Forward Collision Warning, Automatic Emergency Braking, Pedestrian Detection Warning, Automatic Pedestrian Emergency Braking, and Lane Departure Warning have reached 91 to 94 percent market penetration in new vehicles. The average value of semiconductor content per vehicle in the ADAS segment alone is expected to grow from $160 today to more than $260 by 2030.

The rise of electric vehicles has brought huge opportunities to the automotive chip industry. RHO Motion analysts estimate that an electric vehicle uses three times as many semiconductors as a conventional internal combustion engine vehicle. Standard & Poor's forecasts that EV production will grow at a CAGR of 19% from 2023 to 2030, while the CAGR of internal combustion engine vehicle production is expected to decline by about 12% over the same period. By 2030, electric vehicles will account for more than 40% of total vehicle production. Policies and regulations around the world are also strongly promoting the development of electric vehicles, and in Europe, for example, in the face of record greenhouse gas emissions in 2024, Europe is more determined to implement its previous emission reduction targets. This has forced automakers to increase investment in the R&D and production of electric vehicles, thereby increasing the demand for automotive chips.

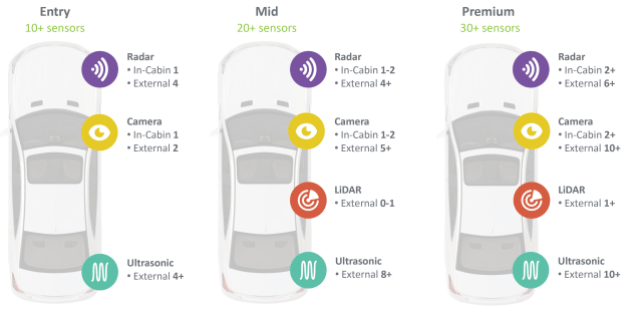

Figure: Sensors are becoming more and more widely used in automobiles (Source: Indie)

From the perspective of automotive interior functions, sensors are becoming more and more widely used in automobiles. The number of sensors varies greatly depending on the level of vehicle. Entry-level vehicles are usually equipped with about 10 sensors, including radar, cameras, ultrasonic sensors, etc.; The number of sensors in intermediate vehicles is more than 20; Luxury vehicles are equipped with 30 or more sensors. Primarily powered by analog, digital, and mixed-signal semiconductors, these sensors are key components in enabling functions such as ADAS and in-vehicle entertainment. The value of the demand for semiconductors for in-vehicle user experience functions is even higher than that of ADAS. Today's consumers are demanding more and more personalization in the car, and they want to be able to easily connect to mobile devices, enable wireless charging, high-speed video transmission, and adjust the atmosphere of the car according to their personal preferences. Standard & Poor's expects the value of semiconductors used for these in-vehicle functions to grow from an average of $350 per vehicle today to about $550 by 2030.

Based on these trends, the future development prospects of the automotive chip industry are very impressive. McKinsey predicts that sales of automotive chips will grow faster than the average for the entire semiconductor industry. S&P Global Mobile expects the total automotive semiconductor market to grow at a CAGR of 9% from 2024 to 2030, growing from $82 billion last year to $149 billion in 2030, a net increase of $67 billion.

Although the future is full of uncertainties in the current complex geopolitical and economic environment, it can be seen that the automotive semiconductor industry will usher in strong growth in the coming years based on various factors and analysts' research. For semiconductor companies that focus on innovation and grasp cutting-edge technologies, the outlook is even brighter.