Ⅰ The installed capacity of the European automobile industry broke the record for the first time

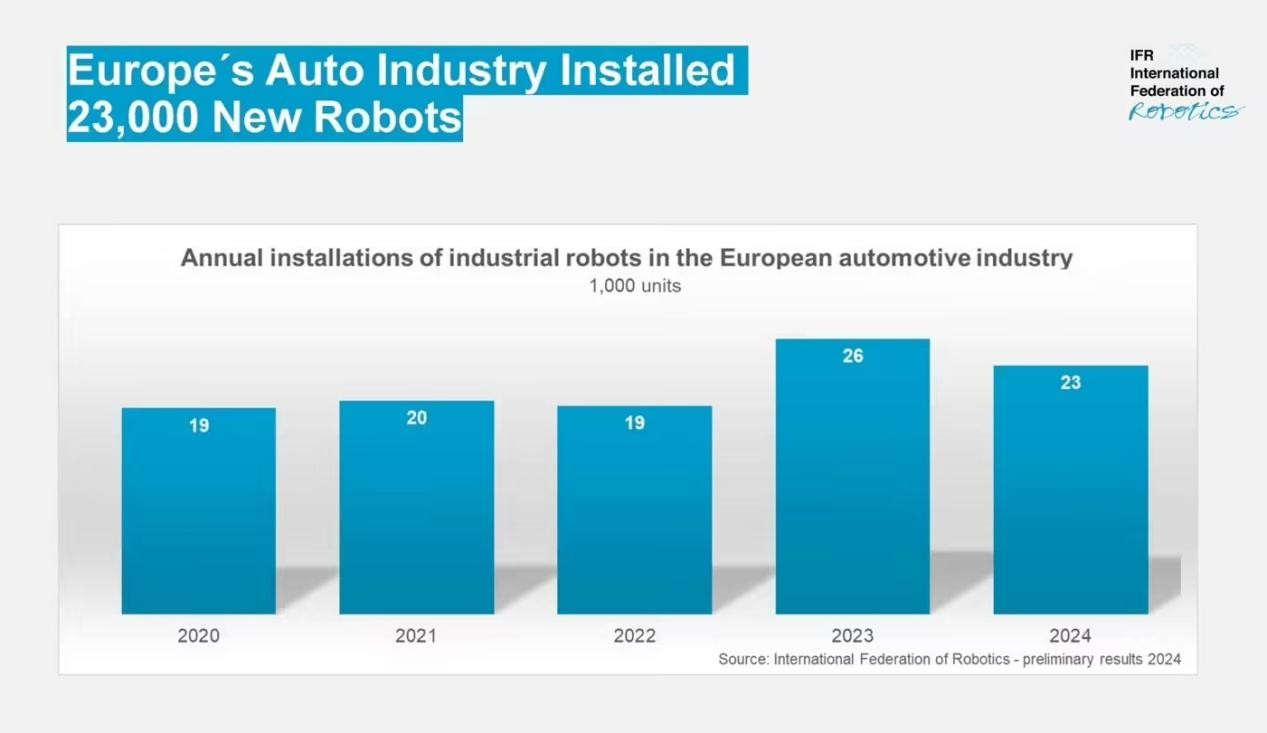

According to the latest data released by the International Federation of Robotics (IFR), the number of newly deployed industrial robots in the European automotive manufacturing industry will reach 23,000 in 2024, the second highest level in the past five years, and at the same time exceed the 19,200 units in North America for the first time. Germany accounts for about 30% of the installed capacity, while the EU as a whole accounts for 85% of the European market share.

From 2019 to 2024, the compound annual growth rate of installed robot capacity in Europe is +3%, reflecting the continuous investment of the automotive industry in the direction of intelligence and automation.

Figure: The number of newly deployed industrial robots in Europe's automotive manufacturing industry will reach 23,000 units in 2024

Ⅱ The advantage of robot density is highlighted: leading the world

In 2023, the density of robots in the European automotive industry is eye-catching:

* Switzerland leads with 3,876 units per 10,000 workers

* 3rd in Slovenia (1,762)

* Germany 6th (1,492), Austria 8th (1,412), Finland 9th (1,288) and Benelux 10th (1,132).

In contrast, the global average robot density in 2023 is only 162 units per 10,000 employees, while Europe as a whole is as high as 219 robots per 10,000 employees, far exceeding North America (197) and Asia (182).

As a leader in intelligent manufacturing in Europe, Germany will add about 9,190 robots to the automotive industry in 2023, a year-on-year increase of 29%, and the total installed capacity at the national level will reach 28,355 units, accounting for more than 30% of the EU. This represents not only a simple quantitative lead, but also reflects the "high-intensity, high-tech" European automobile manufacturing ecology that has begun to take shape.

Ⅲ Structural Analysis: Why Can Europe Overtake?

1. Progressive structural optimization

The European automotive industry has a high rate of automation, and investment is concentrated in key links such as welding, spraying and intelligent transportation. According to IFR data, the number of robots installed in the automotive industry will reach 69,388 units in 2023, accounting for 45% of the world's total, ranking first among all industries. This shows that the automation of the European automotive side has entered the stage of "deep implantation".

2. Nearshore manufacturing and supply chain remodeling

In the past two years, the epidemic and geopolitics have driven the manufacturing industry back to Europe. In response to supply chain risks, automakers accelerated the introduction of local automation equipment and cleared the lagging orders in 2021–22 ahead of schedule, resulting in a 9% surge in installed capacity to 92,393 units in 2023.

3. Policy incentives and capital alliances

The EU and its member states generally subsidize investment in intelligent manufacturing, implement the "Industry 4.0 plan", and incorporate it into the carbon neutrality strategy. Germany, France, and Italy have introduced special funds to help robot manufacturers and car companies form upstream and downstream cooperation. Because of this, small and medium-sized manufacturers have also tested the waters of automation and promoted the path of "collaborative robot + customized production".

Ⅳ Germany's example: challenges and responses coexist

As the No. 1 robot application market in Europe, Germany has obvious advantages:

* The density of robots reached 429 units per 10,000 workers, ranking fourth in the world;

* The total installed capacity in the country was 28,355 units, of which 9,190 units were installed in the automotive industry, ranking first, with an increase of 29%.

However, in recent years, economic growth has slowed down and investment confidence has fluctuated, and the peak demand for local robots may have seen a "turning point". Although German robot manufacturing giants such as KUKA (KUKA) achieved revenue of 4.4 billion euros, they are facing dual pressure from global layout and local market.

Ⅴ Challenge the four quadrants: double pressure from the outside and from within

Figure: Pressure from the outside and from the inside

Ⅵ The Rise of Intelligent Change: A New Track of Robot + AI

Start-ups such as Neura Robotics are spearheading "cognitive collaborative robots" with the goal of improving the robot's perception of the environment and its dynamic adaptability. This "brain + body" robot is making up for the weak link of industrial automation and is expected to become a new engine of European competition.

The technical accumulation includes:

* Fusion sensor: support machine vision fusion LiDAR to achieve accurate recognition and navigation;

* Edge inference module: ensure low-latency decision-making and meet the requirements of workshop conditions;

* Platform-driven ecology: Establish a data hub connected with ERP/MES to achieve transparency in the manufacturing process.

This series of progress means that Europe is moving from "installing more robotic arms" to "building intelligent manufacturing systems".

Ⅶ Munich Roundtable 2025: The Crossroads of European Automation

On June 25, 2025, IFR will hold an executive roundtable at the automatica trade fair in Munich, covering topics such as "Competitiveness", "Policy Coordination" and "New Market Expansion" and other core issues.

At that time, it is expected to announce the latest medium and long-term strategy of the European robot industry, focusing on the response:

* How to deal with supply chain shocks in Asia?

* How to tilt policy incentives towards "collaborative intelligence" technologies?

* How to expand the landing scenarios of small and medium-sized enterprises and form an automation ecosystem with process nodes as the core?

This is an important moment to test whether Europe can rebuild its global position in the Fourth Industrial Revolution.

Ⅷ Conclusion: From the leading installed capacity to intelligent leadership

The European automotive industry has a strong automation offensive, with the installed capacity surpassing North America in 2024, and the density of many robots is in the forefront. Germany leads the way and is structurally solid. However, it is not enough to rely on the advantage of quantity, and the real future lies in the breakthrough of "intelligent collaboration", "AI empowerment" and "platform integration".

When robots can not only operate, but also perceive, judge, and collaborate, Europe's manufacturing force will enter the "era of intelligent manufacturing ecology" from hardware. This is not only an upgrade of Industry 4.0, but also a new leap towards "Manufacturing 5.0". This may determine the direction of competition in the next round of global industrial structure.

If Europe can maintain policy dividends, give full play to the synergistic advantages of Germany-SMEs, and successfully transform in the direction of "robotics + AI + ecological platform", then this is not only an accident of overtaking in quantity, but also a deep industrial reshaping.