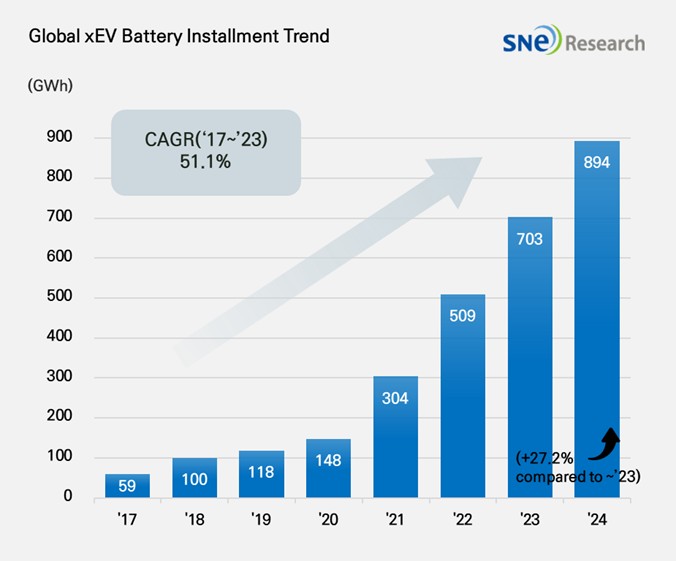

Recently, a report released by SNE Research shows that the global battery usage of electric vehicles (EV, PHEV, HEV) will reach about 894.4GWh in 2024, a year-on-year increase of 27.2%, continuing the upward trend in recent years and showing the vigorous development trend of the electric vehicle industry.

From the perspective of market share, the global electric vehicle battery market pattern has changed significantly. South Korea's three major battery companies, LG Energy Solutions, SK On and Samsung SDI, which have long held important positions, will have a combined market share of 18.4% in 2024, down 4.7% from the same period last year. Among them, LG Energy Solution maintained its third place in the world with a year-on-year increase of 96.3GWh and a year-on-year increase of 1.3% due to the growth of sales of customer models such as Tesla. SK On ranked 5th due to the strong performance of some Hyundai Motor Group models and related models of Mercedes-Benz, Ford, and Volkswagen, with a 12.4% increase in usage (39.0 GWh). However, Samsung SDI showed a negative growth of 10.6% (29.6GWh), mainly due to the fluctuation of sales of models of its main customers BMW, Rivian and Audi, such as the replacement of LFP batteries on the Rivian standard range model, and the decline in sales of the Audi Q8 e-Tron, which directly led to the decrease in the installed capacity of Samsung SDI.

Panasonic, as an important battery supplier to Tesla, ranked 6th in 2024, but its battery usage was 35.1GWh, down 18.0% year-on-year. This is mainly due to the decline in sales due to the facelift of Tesla's Model 3 in early 2024, as well as the decline in Tesla's overall sales in 2024. However, Panasonic plans to quickly regain market share in the North American market with the advanced 2170 and 4680 batteries supplied to Tesla.

Chart: Global Monthly EV and Battery Tracker, January 2025, (image: SNE Research)

Chinese battery companies will perform well in 2024. With a year-on-year growth of 31.7% (339.3GWh), CATL continues to hold the top spot in the world. Its wide customer base is the key to growth, not only domestic car companies such as Zeekr, Wenjie, and Li have adopted a large number of them, but also global mainstream OEMs such as Tesla, BMW, Mercedes-Benz, and Volkswagen have also chosen CATL's batteries. BYD also performed well, ranking second, with a year-on-year increase of 37.5% (153.7GWh). BYD has sold about 4.14 million electric vehicles in 2024 and plans to sell about 6 million units in 2025, and is actively expanding into the Asian and European markets to further increase its market share.

The significant growth of the global electric vehicle battery market in 2024 is the result of a combination of factors. In terms of policies, in order to promote the development of green transportation, countries continue to introduce policies to encourage the development of electric vehicles, such as car purchase subsidies and tax exemptions, which have stimulated the consumption of electric vehicles and led to the growth of battery demand. Technological advances are also crucial, with technological breakthroughs such as increased battery energy density and faster charging speeds enhancing the utility and attractiveness of electric vehicles, prompting more consumers to choose electric vehicles. At the same time, automakers continue to enrich their electric vehicle product lines, covering sedans, SUVs and other models, meeting the needs of different consumers and expanding the market scale.

Looking to the future, the global electric vehicle battery market has both opportunities and challenges. With a solid foundation in the domestic market and increasing technological strength, Chinese enterprises are becoming increasingly competitive in the global market. In the face of uncertainties in the U.S. and European markets, Korean battery companies need to actively respond, such as optimizing the supply chain, reducing production costs, and increasing investment in technological innovation. For the entire battery industry, it is not only necessary to rely on expanding production capacity, but to enhance core competitiveness through differentiated technology and the construction of a sustainable supply chain to adapt to the changing market environment and achieve sustainable development.