According to the Semiconductor Manufacturing Monitoring Report (SMM) jointly released by SEMI and TechInsights, the global semiconductor manufacturing industry showed strong recovery momentum in the third quarter of 2024, marking the first time in two years that all key industry indicators achieved positive growth sequentially. This growth was mainly driven by seasonality and strong demand from AI data center investments, but the recovery in the consumer electronics, automotive, and industrial sectors remained slow. This growth trend is expected to continue into the fourth quarter of 2024.

Strong market demand and sales growth

After experiencing a decline in the first half of 2024, electronics sales rebounded in the third quarter, rising 8% quarter-on-quarter, and are expected to increase another 20% quarter-on-quarter in the fourth quarter. Integrated circuit (IC) sales also increased 12% sequentially in the third quarter and are expected to grow another 10% in the fourth quarter. Overall, IC sales are expected to increase by more than 20% year-on-year in 2024, with storage products being the main growth driver. This growth was driven by the overall recovery in memory chip prices and the strong demand for memory chips in data centers.

Capex has rebounded significantly

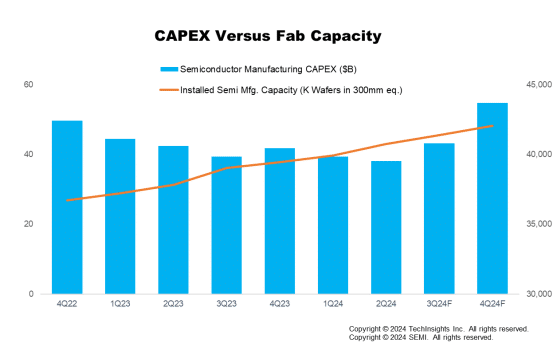

Semiconductor capital expenditures (CapEx) began to pick up in the third quarter after declining in the first half of 2024. Storage-related capex was particularly prominent, up 34% sequentially and 67% year-over-year. Total capital expenditures are expected to increase 27% sequentially and 31% year-over-year in the fourth quarter, with storage-related spending expected to increase 39% year-over-year, continuing to lead this trend.

The semiconductor capital equipment market performed better than expected, driven by significant investments in China and increased investment in high-bandwidth storage (HBM) and advanced packaging technologies. Wafer fabrication equipment (WFE) spending increased 15% year-over-year and 11% sequentially in the third quarter. At the same time, spending on test equipment and assembly and packaging equipment increased by 40% and 31%, respectively, year-over-year, and is expected to continue to grow for the remainder of 2024.

Figure: Global semiconductor manufacturing industry recovers strongly in the third quarter of 2024 (Source: SEMI)

Wafer capacity continues to expand

In the third quarter of 2024, global wafer manufacturing capacity reached 41.4 million wafers per quarter (in terms of 300mm wafers) and is expected to grow by 1.6% in the fourth quarter. Among them, foundry and logic-related capacity growth is particularly outstanding, with a quarter-on-quarter increase of 2.0% in the third quarter and an expected increase of 2.2% in the fourth quarter, mainly driven by the expansion of advanced nodes and mature nodes. Storage capacity grew 0.6% in the third quarter and is expected to continue at the same pace in the fourth quarter. This growth was primarily driven by the need for high-bandwidth storage, partially offset by the process node transition.

Industry expert perspectives

"In 2024, the semiconductor capital equipment segment has shown strong growth momentum, driven by significant investment in China and increased investment in advanced technologies," said Clark Tseng, senior director of market intelligence at SEMI. In addition, the continued expansion of fab capacity, especially in the foundry and logic sectors, shows that the industry is responding to the growing demand for advanced semiconductor technologies.”

Boris Metodiev, Director of Market Analysis at TechInsights, added: "In 2024, the semiconductor industry presents two different aspects. On the one hand, the recovery of consumer electronics, automotive and industrial markets is weak; On the other hand, the AI market has performed well, pushing up the average selling price of storage and logic products. With interest rates gradually declining in 2025, consumer confidence is expected to recover, driving further recovery in the consumer electronics and automotive markets. ”

Semiconductor Manufacturing Monitoring Report (SMM)

The SMM report provides comprehensive coverage of the global semiconductor manufacturing industry, from capital equipment and fab capacity to semiconductor and electronics sales, revealing key industry trends and providing capital equipment market forecasts. The report includes quarterly data for the past two years as well as an industry supply chain outlook for the next quarter, covering leading IDM companies, fabless design houses, foundries and test fabs.