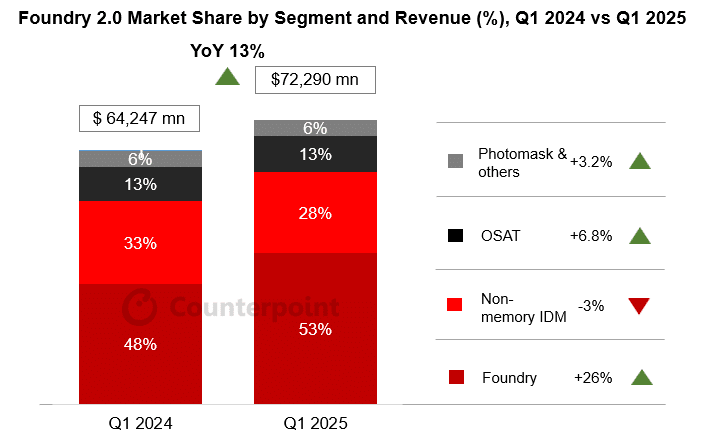

In the first quarter of 2025, the global "foundry 2.0" market achieved strong growth, with revenue increasing by 13% year-on-year to $72.29 billion. This growth is mainly driven by the surge in demand for artificial intelligence and high-performance computing (HPC) chips, which are driving the large-scale adoption of advanced process nodes (e.g., 3nm, 4/5nm) and high-end packaging technologies (e.g., CoWoS).

Compared with the traditional "foundry 1.0" model, which focuses on chip manufacturing, today's industrial landscape has undergone fundamental changes. The AI trend has led to the rise of system-level collaborative optimization, and the role of enterprises has also shifted from a single manufacturing participant to a technology integration platform. In order to better characterize this changing trend, the industry has included pure foundry, non-memory IDM, package and test (OSAT) and photomask manufacturers into the category of "foundry 2.0", rather than focusing only on foundry companies in the traditional sense.

Market size and growth:

The global semiconductor foundry market size is valued at USD 79.8 billion in 2023. The market size is expected to grow at a CAGR of 4.92% from 2023 to 2033, reaching USD 129 billion by 2033.

The global semiconductor foundry market size is valued at USD 86.88 billion in 2024. The market is expected to grow at a CAGR of 5.03% from 2025 to 2033 to reach USD 135.65 billion by 2033.

Market Drivers:

Growing demand for consumer electronics: The semiconductor foundry market is driven by the increasing demand for high-performance, energy-efficient semiconductor solutions for consumer electronics such as smartphones, tablets, and wearables.

Emerging Technology Development: The rapid development of emerging technologies such as artificial intelligence, machine learning, deep learning, Internet of Things, 5G, etc., which requires advanced chips to process complex mathematical calculations and large data sets, has brought growth momentum to the semiconductor foundry market.

Transformation in the automotive industry: The shift to electrification and autonomous driving in the automotive industry has increased the demand for semiconductor components, which play a key role in vehicle control and intelligent functions.

Figure: Driven by demand for AI chips, the global semiconductor foundry 2.0 market will see year-on-year revenue growth in the first quarter of 2025

In terms of market share, Brady Wang, associate director of research, noted: "TSMC continues to be the industry leader, expanding its market share to 35%, and its annual revenue growth has reached a mid-double-digit level. Thanks to its leading position in advanced manufacturing processes and a large number of orders for AI chips, TSMC is a strong leader. In contrast, Intel is relying on the 18A process and Foveros 3D packaging to gradually accumulate momentum, while Samsung has made a breakthrough in the 3nm GAA process, but it is still plagued by yield instability.”

With the rapid rise in demand for advanced packaging, OSAT manufacturers have become one of the key links in the "Foundry 2.0" supply chain. The segment grew nearly 7% year-over-year in the first quarter of 2025, driven by the expansion of advanced packaging capacity by companies such as ASE, SPIL and Amkor. These manufacturers have benefited from TSMC's AI-related CoWoS packaging capacity spillover orders, but the overall capacity is still limited by both yield and production capacity.

At the same time, non-storage IDM vendors (e.g., NXP, Infineon, Renesas) continued to face weak demand in the automotive and industrial sectors, with revenue down 3% year-on-year. Although inventories have gradually returned to normal levels, a full recovery is not expected until the second half of 2025. Relatively speaking, with the acceleration of the implementation of EUV technology in the 2nm process and the increase in the complexity of AI and chiplet design, photomask manufacturers have ushered in growth opportunities.

"AI is becoming a core driver of semiconductor growth and reshaping the priorities of the entire foundry supply chain," said William Li, senior analyst. In this wave, TSMC and major packaging manufacturers are undoubtedly the most direct beneficiaries. Looking to the future, "Foundry 2.0" is gradually moving away from linear manufacturing thinking and shifting to a collaborative and integrated value chain system. Deep collaboration between design, manufacturing, and packaging will be key to driving the next wave of innovation. Especially in the context of the continuous advancement of AI and chiplet integration and system-level optimization, the competitive landscape of the semiconductor industry is accelerating its reconstruction.