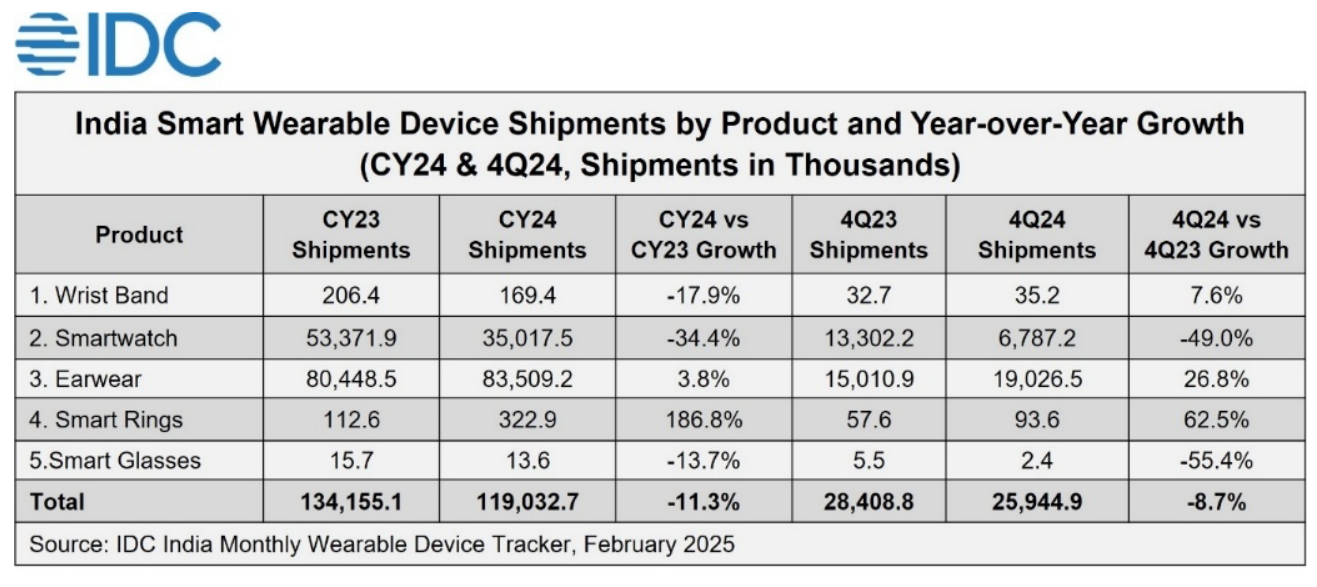

According to the International Data Corporation's (IDC) India Monthly Wearables Tracker, India's annual wearable device shipments fell to 119 million units in 2024, down 11.3% year-on-year. Not only that, but the market has shrunk for three consecutive quarters, with shipments of 25.9 million units in the fourth quarter of 2024, down 8.7% from the same period last year. At the same time, the average selling price of overall wearables has also shifted from a double-digit decline for five consecutive years to a 7.1% decline to $19.8 in 2024.

Among the sub-categories, the smart watch market has been hit hard. In 2024, its shipments will drop sharply by 34.4% year-on-year to only 35 million units, and its share of the wearable device market will also plummet to 29.4% from 39.8% in 2023. Due to the lack of attractive innovations and technological breakthroughs, consumers' enthusiasm for buying smartwatches has decreased significantly. In terms of price, the average selling price of a smartwatch dropped from $25.8 to $23.5, a drop of 9.1%. Even though the market share of premium smartwatches has increased, from 2.1% to 2.8%, its shipments are still down 13.1% year-on-year.

In contrast, the market for ear wearables is relatively positive. In 2024, the shipment of ear wearables will reach 83.5 million units, achieving a modest year-on-year growth of 3.8%. Among them, the market share of true wireless stereo (TWS) earbuds reached a record 70.9%, a significant increase from 67.2% in 2023, and shipments increased by 9.4% year-on-year. However, headset shipments fell by 17.1%, in stark contrast to headphone shipments, which grew by 83.6% to 4.5 million units. The annual average selling price of ear wearables was $17.6, a slight decrease of 3.0%.

The emerging category of smart rings is showing strong development potential. In 2024, shipments will increase to 323,000 units from 113,000 units in 2023, and the average selling price will increase by 1.9% to $174.7. In the smart ring market, Ultrahuman leads the way with a 40.1% share, followed by Pi Ring and Aabo with 20.4% and 16.8% share, respectively.

Chart: India's smart wearables market shipments in 2024

In terms of brand competition, Boat continued to maintain its leading position in the overall wearable device market, with its market share increasing from 26.0% to 27.6%; Noise came in second with a 12.2% share; Boult was the only brand in the top five to see growth, up 10.8%. In the TWS earbuds segment, Boat, Boult and Nexxbase all achieved double-digit annual growth.

From the perspective of sales channels, offline channels will perform well in 2024, with shipments increasing by 7.2% and market share increasing from 31.3% to 37.8%. The online channel, which has maintained double-digit growth in the previous few years, will see a 19.7% year-on-year decline in shipments in 2024, of which the online shipments of smart watches will decline by 43.0%, which will have a greater impact on the overall online channel shipments, and the online shipments of ear wearable devices will also decline by 5.1%.

Looking ahead to 2025, the Indian wearables market is full of uncertainties. Vikas Sharma, senior market analyst at IDC India, predicts that the Indian wearables market is likely to remain flat in 2025. The continued downward trend of the smartwatch category is expected to continue, and the lack of innovation exposed in 2024 will be difficult to effectively solve in the short term, and it will be difficult for consumer demand to be fully stimulated, which will continue to pull down the growth level of the entire market. However, in-ear wearables are expected to achieve single-digit growth due to the continued popularity of TWS earbuds and the growth potential of headsets.

It is worth expecting that emerging categories such as smart rings and smart glasses will become an important driver of market growth. With the continuous advancement of technology, smart rings will continue to be optimized in health monitoring, convenient interaction and other functions to attract more consumers to buy. Smart glasses will also gradually move from concept to mature application, bringing users a new experience in AR, information display and other aspects. These emerging categories are expected to achieve high double-digit growth, injecting new vitality into the market.

Technological innovation will be key in the future. The convergence of advanced sensing technology and artificial intelligence will bring more possibilities to wearable devices. For example, more accurate health monitoring functions, in addition to the existing heart rate and sleep monitoring, complex functions such as blood pressure monitoring will gradually become popular; Through AI algorithms, devices are able to better understand user habits and provide personalized services and recommendations. In addition, product design and user experience will also be emphasized, and manufacturers will pay more attention to the comfort of products, the appearance of fashion, and the seamless connection with other smart devices.