In the global semiconductor industry, the NAND Flash market has always played a pivotal role. Recently, the news that Kioxia plans to reduce production in December 2024 has made waves in the global storage market like a bombshell. This decision is not only related to Kioxia's own market strategy, but may also become a key factor affecting the balance of supply and demand in the global NAND Flash market. Against the backdrop of global economic volatility and supply chain tensions, Kioxia's decision to cut production is particularly compelling. In this article, China Exportsemi will delve into the data support, market impact and future trends behind this decision, and reveal the far-reaching impact of Kioxia's production cut on the NAND Flash market.

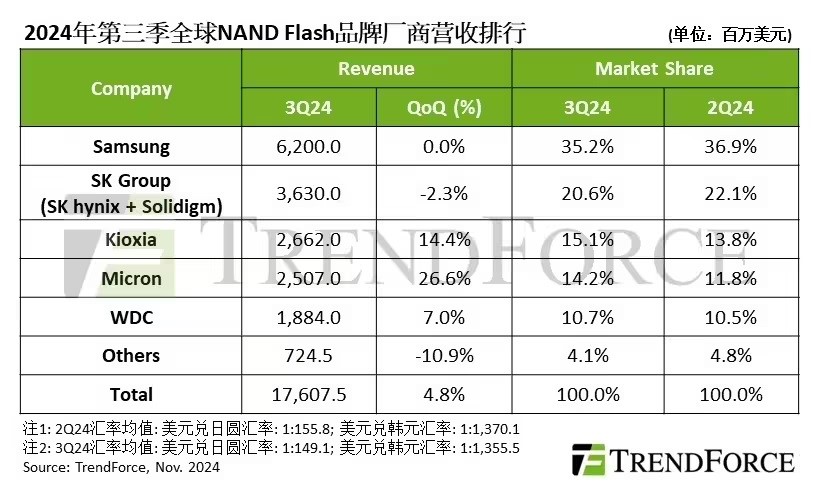

Kioxia's decision to reduce production is not an isolated incident, but is made against the backdrop of changes in supply and demand in the global NAND Flash market. According to TrendForce's estimates, while enterprise SSD prices were able to flatten in the fourth quarter, contract prices for the rest of the product categories have started to fall. Kioxia achieved revenue of $2.662 billion, up 14.4% quarter-on-quarter, thanks to the peak U.S. smartphone production season and increased shipments of enterprise-class SSDs, resulting in a 9% quarter-on-quarter increase in shipment capacity, coupled with an increase in average selling unit price.

Figure: Global NAND Flash brand revenue ranking in the third quarter of 2024

1. The impact of production cuts on prices

Kioxia's production cut is expected to help the price of NAND Flash stop falling or reverse. At present, the capacity utilization rate of NAND original factories is close to the full load level, but the capital expenditure in 2025 is still lower than the past average, with TLC to QLC and 1YY-L process upgrade 2XX-L as the main direction. The inventory turnover days of major OEMs have returned to their normal level of 10 to 12 weeks, and it is expected that in addition to Kioxia, major manufacturers such as Samsung will also reduce production to keep NAND Flash prices stable.

2. Technological development and market demand

Technological advancements are the key factors driving the growth of the NAND Flash market. According to the technical roadmap of global NAND flash memory manufacturers, Samsung, Hynix, and Micron all plan to launch 128-layer TLC/QLC products, and QLC will gradually develop and become mainstream. China's YMTC technology is also emerging in the global market, with 128-layer 3D NAND samples sent to memory controller manufacturers, and production capacity and output are in the ramp-up stage.

3. Supply and demand and market forecasts

From the perspective of supply and demand, although the production cuts of Kioxia and other major manufacturers may have an impact on market supply, YMTC expects to increase production capacity to 135Kwpm in 2025, although this only accounts for 8-10% of the market output, and the impact on NAND Flash prices in the short term is still limited. In the third quarter of 2024, the global NAND Flash market size reached $19.021 billion, an increase of 5.7% quarter-on-quarter and 93.9% year-on-year. This indicates that the market demand for NAND Flash is still strong.

4. Conclusion

Kioxia's decision to cut production is an adjustment to its market position and future trends. In the current NAND Flash market facing falling prices and inventory adjustments, production cuts help stabilize market prices and provide room for technological advancement and capacity expansion. While the market may still face challenges in the short term, technology developments and capacity expansion will drive the market's growth in the long term. This strategy of Kioxia may win more leverage in the highly competitive NAND Flash market and contribute to the healthy development of the industry.

In the global NAND Flash market, Kioxia's production reduction is not only a response to current market conditions, but also a prediction of future market trends. With the continuous advancement of technology and the continuous growth of market demand, the future of the NAND Flash market is still full of uncertainties. Kioxia's production cuts may be a sign of this turning point in the market, and it deserves our continued attention.