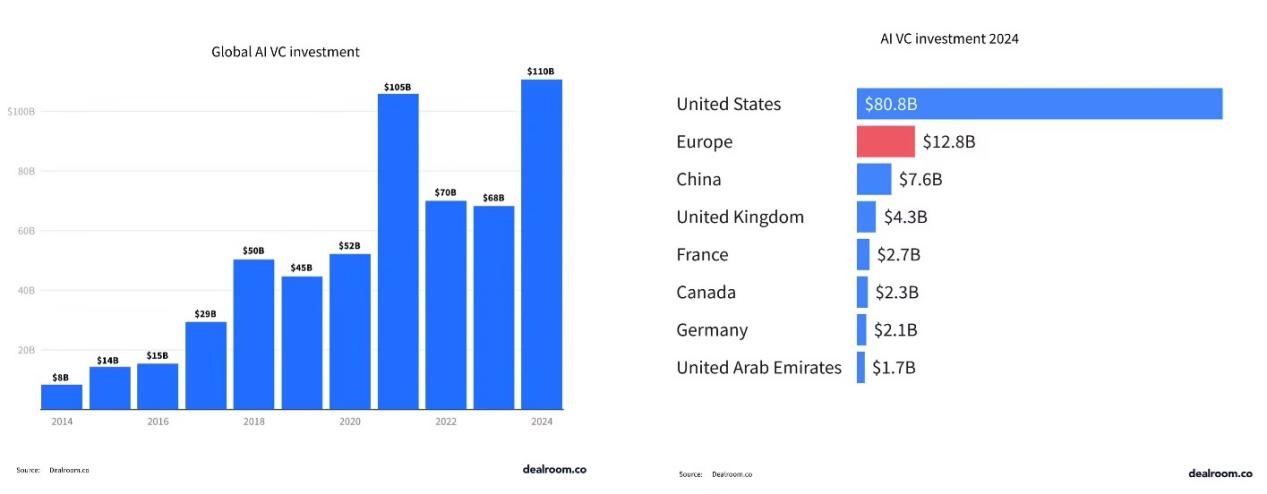

In the field of technology investment in 2024, the picture of ice and fire is clearly presented: on the one hand, AI investment is soaring like a rocket, and on the other hand, the overall financing of technology start-ups is in a downward trend. According to a report by data analytics firm Dealroom, AI startups raised a total of $110 billion in funding in 2024, up 62% from the previous year, while startups and growth companies across the tech sector (including non-AI sectors) raised a total of $227 billion in 2024, down 12% from 2023. This stark contrast has undoubtedly become the focus of the capital market, and it has also triggered in-depth thinking about the development pattern of the technology industry.

AI investment has skyrocketed: the rise of new capital favorites

Technological breakthroughs and market potential

AI technology has made remarkable breakthroughs in recent years, especially the emergence of generative AI, such as OpenAI's ChatGPT, which has completely changed people's perception of AI. With its ability to generate high-quality text, images, audio, and more, it opens up innovative possibilities for numerous industries. Taking content creation as an example, articles, stories, and drawings that used to require a lot of manpower and time to create can now be generated in a short period of time with the help of generative AI, which greatly improves the efficiency of creation. This technological breakthrough has allowed the market to see the potential of AI in a wide range of applications in content creation, customer service, education, medical care, and other fields, thus attracting a large influx of capital.

Expansion of application scenarios

The application scenarios of AI continue to expand, from the initial search engine optimization and recommendation system to today's complex fields such as autonomous driving, intelligent security, and medical diagnosis. For example, the development of autonomous driving technology is expected to revolutionize the transportation industry, improving traffic safety and efficiency. As a leading company in the field of autonomous driving, Waymo has received a huge amount of financing in 2024, which is the recognition of its application scenarios and development potential by capital. In the field of intelligent security, AI technology can achieve intelligent identification and early warning through video surveillance, and improve the city's security and prevention capabilities. These expanding application scenarios provide a broad market space for AI companies, and investors are full of expectations for their future earnings.

Chart: AI investment performance in 2024

Driven by infrastructure demand

Building and operating AI services requires robust infrastructure, including data centers, high-performance chips, and more. As AI technology evolves, so does the need for infrastructure. For example, large language models require a lot of computing resources to train and reason, which has prompted companies to invest more in infrastructure. As a leader in the field of data processing and management, Databricks topped the AI financing list with a financing amount of $10 billion in 2024. At the same time, some chip manufacturers are also increasing their R&D investment in AI chips to meet the market demand for high-performance chips, further driving the growth of AI investment.

The rise of the open-source model

Although the cost of building AI services is high, the emergence of open-source models makes it possible to reduce costs. The open source of projects such as DeepSeek enables more enterprises and developers to participate in the R&D and application of AI technology, accelerating the popularization and promotion of AI technology. The open-source model not only reduces the R&D cost of enterprises, but also promotes technological innovation and cooperation, providing new impetus for the growth of AI investment. For example, some SMEs can gain a foothold in the market by using open-source AI models and tools to quickly develop competitive products and services. The rise of this open-source model has also brought more opportunities and possibilities for AI investment.

Declining financing for tech start-ups: the dilemma of the old love

Uncertainty of the economic environment

In 2024, the global economy will face many uncertainties, such as slowing economic growth, inflationary pressures, and geopolitical tensions. These factors have made investors more cautious about investing in tech start-ups, preferring to invest their money in areas with more stability and returns. In contrast, the high growth potential and market demand in the AI space make it more attractive in an environment of economic uncertainty, leading to a decline in overall funding for tech start-ups. For example, some venture capital firms that originally planned to invest in technology start-ups chose to wait and see or adjust their investment strategies due to concerns about the uncertainty of the economic situation, and invested their funds in hot areas such as AI.

Intensified competition in the industry

The tech industry is becoming increasingly competitive, with start-ups facing competitive pressure from big tech companies and peers. With their strong technical strength, brand influence and financial advantages, large technology companies continue to expand their business areas, squeezing the living space of start-ups. For example, tech giants such as Apple and Google dominate areas such as smartphones and search engines, making it difficult for start-ups in related fields to gain market share. At the same time, the competition among technology start-ups has become increasingly fierce, resulting in the concentration of market resources in a small number of excellent companies, resulting in a decline in the overall financing scale. For example, in the field of sharing economy, early bike-sharing companies such as ofo have gradually withdrawn from the market due to fierce market competition and operating model problems, while the remaining companies are also facing financing difficulties.

Long return on investment cycle

The return on investment cycle of technology start-ups is relatively long, and they need to go through multiple stages such as technology research and development, marketing, and user accumulation to achieve profitability. In the uncertain economic environment, investors are more inclined to choose investment projects with fast short-term returns and lower risks. Some applications in the field of AI, such as the application of generative AI in content creation and customer service, can quickly realize business value and attract more investors' attention. For example, some generative AI-based content creation tools can generate high-quality content for users in a short period of time to monetize their business, while traditional tech start-ups such as software development companies may need to spend years on technology research and marketing to become profitable, which makes investors worry about their return on investment cycles.

Comparison and enlightenment

The investment field is clearly differentiated

The surge in AI investment in 2024 contrasts sharply with the decline in overall funding for tech start-ups, reflecting a divergent trend in the investment landscape. As one of the most promising technology fields at present, AI has attracted a lot of capital investment, while other technology fields are facing financing difficulties. This divergent trend shows that investors pay more attention to the innovation and market potential of technology when choosing investment projects, and are more willing to invest in areas with high growth potential and wide application prospects. For example, the application of AI in the healthcare field, such as medical imaging diagnosis, disease prediction, etc., has broad market prospects and has attracted the attention of a large number of investors, while traditional technology fields such as electronic manufacturing are relatively difficult to obtain financing due to fierce market competition and difficult technological innovation.

The importance of technological innovation and market demand

The surge in AI investment is due to its strengths in technological innovation and market demand. The continuous breakthrough of AI technology and the expansion of application scenarios have brought tangible value to enterprises and consumers, thus attracting the attention of a large number of investors. In contrast, other technology fields will struggle to win the favor of investors if they lack the support of technological innovation and market demand. For example, some traditional science and technology fields, such as home appliance manufacturing, are relatively difficult to obtain due to relatively slow technological innovation and relatively stable market demand. Therefore, technology start-ups need to focus on the combination of technological innovation and market demand, and constantly improve their core competitiveness in order to stand out in the fierce market competition.

The potential of the opensource model

The rise of opensource models in the field of AI provides new ideas for reducing costs and promoting technological innovation. For tech start-ups, the open-source model can reduce R&D costs and accelerate technological innovation and product iteration. At the same time, the open- source model can also promote cooperation and communication between enterprises, and jointly promote the development and application of technology. For example, some open-source AI frameworks, such as TensorFlow and PyTorch, provide developers with convenient development tools, lower the development threshold, and promote the popularization and promotion of AI technology. Technology start-ups can learn from the experience of the open- source model to explore open-source strategies suitable for their own development and enhance the competitiveness of their enterprises.

The far-reaching impact on the semiconductor industry

The promotion of the AI investment boom to the semiconductor industry

The surge in AI investment has given a huge boost to the semiconductor industry. The development of AI technology has put forward higher requirements for the performance and power consumption of semiconductor chips, prompting semiconductor companies to increase R&D investment and promote the upgrading and innovation of chip manufacturing processes. For example, in order to meet the demand for computing performance for AI training and inference, semiconductor companies such as NVIDIA have continuously launched high-performance GPU chips, such as A100 and H100, which have been widely used in the AI field and promoted the technological progress of the semiconductor industry. At the same time, the increase in AI investment has also led to a boom in the semiconductor market, bringing more business opportunities and revenue growth to semiconductor companies.

The challenge of the decline in financing of technology start-ups to the semiconductor industry

The decline in funding for tech start-ups has also brought certain challenges to the semiconductor industry. Some technology start-ups have innovative technologies and products in semiconductor-related fields, but due to financing difficulties, they may not be able to achieve commercialization and large-scale development, thus affecting the technological innovation and market competitiveness of the semiconductor industry. For example, some start-ups focusing on chip design are unable to carry out large-scale chip manufacturing and testing due to lack of financial support, resulting in products that cannot be brought to market. In addition, the decline in the financing of technology start-ups may also lead to a deterioration of the investment environment in the semiconductor industry, affecting the financing and development of semiconductor companies.

Opportunities and coping strategies in the semiconductor industry

Faced with the dual impact of the AI investment boom and the decline in funding for tech start-ups, the semiconductor industry faces both opportunities and challenges. On the one hand, semiconductor companies should seize the opportunity of the AI investment boom, increase R&D investment in the field of AI chips, improve chip performance and power consumption ratio, and meet the market demand for high-performance chips. For example, semiconductor giants such as Intel and AMD are also increasing investment in the research and development of AI chips and have launched a variety of competitive chip products. On the other hand, semiconductor companies should pay attention to the development of technology start-ups, support start-ups with innovative technologies through investment and cooperation, and jointly promote technological innovation and market development in the semiconductor industry. For example, some semiconductor companies can provide capital, technology and market support for technology start-ups by setting up industrial funds and incubators to promote the ecological construction of the semiconductor industry.

Conclusion

The surge in AI investment and the decline in financing for tech start-ups in 2024 is a microcosm of the development process of the technology industry, reflecting the changes in the capital market and the development trend of the technology industry. As the new darling of capital, AI has attracted a large amount of capital investment and become the focus of the technology industry due to its technological breakthroughs, application scenario expansion and market demand growth. However, technology start-ups, as old favorites, are facing financing difficulties due to factors such as the uncertain economic environment, intensified competition in the industry, and long return on investment cycles. This phenomenon enlightens us that in the development process of the science and technology industry, technological innovation and market demand are the key to enterprises to gain the favor of capital, and the rise of the open- source model also provides new ideas for the development of enterprises. For the semiconductor industry, it is necessary to seize the opportunity of the AI investment boom, and at the same time pay attention to the development of technology start-ups, so as to jointly promote technological innovation and market prosperity in the semiconductor industry.