Ⅰ. Foreword - Bet on 2nm to reshape the global strategic landscape

On June 24, ZDNet Korea and SEDaily reported that Samsung Electronics' wafer foundry department officially adjusted its global resource layout: it will strive to achieve 2nm mass production at the Taylor wafer factory in Texas, USA in January ~ February 2026, and at the same time postpone the 1.4nm test line originally deployed in Pyeongtaek 2 to the end of the year or early next year, and the 1.4nm mass production target may be postponed to 2028 。 This major decision not only reflects Samsung's strategic ambition to seize the advanced node in the United States, but also exposes its technical yield and resource allocation problems.

Ⅱ. 2nm priority: technical contradictions and production line layout

2.1 Detailed explanation of the 2nm layout of the Taylor factory

Taylor's wafer fab was originally planned to be a 4nm process, but was later upgraded to a 2nm process base in accordance with the CHIPS Act subsidy requirements and the U.S. chip production vision. According to TrendForce, the plant's cleanroom renovation has been restarted in Q2 2025, with the goal of completing the cleanroom construction by the end of 2026, followed by the introduction of 2nm equipment. A number of media outlets such as Android Headlines pointed out that the project is expected to be mass-produced in Q1 (January~February) in 2026.

However, Tom's Hardware and TechSpot disclosed as early as 2024 that the site had suffered serious yield issues at the 2nm node, resulting in a large number of personnel evacuation and a postponement of the production time to 2026. Industry rumors point out that the early 2nm yield is only 10%–20%, which is a serious drag on mass production. However, Wccftech reported in April this year that the yield rate has increased to about 40%, showing a warming trend.

At present, the judgment criteria are very clear: if the yield rate of more than 50% cannot be maintained by the end of 2025, Samsung's "first-mover advantage" in the US market will be surpassed.

Figure: Samsung's "all-or-nothing": 2nm mass production first, 1.4nm postponed to 2028, a big bet on the United States chip chess

2.2 The 1.4nm project is postponed, and the resource "backflow" is analyzed

In stark contrast to the 2nm node, the 1.4nm node test line project at the Pyeongtaek Plant 2 plant in South Korea has been forced to postpone the launch to the end of 2024 or early 2025, and the high-intensity production target has been pushed to 2028. This strategic shift means that Samsung will take the initiative to "reverse transfer" its capital, manpower, and equipment resources from the 1.4nm system to 2nm to ensure that the U.S. base "fires the first shot". It can be seen that the current strategy is to "concentrate firepower and highlight 2nm", and abandon the ubiquitous node advancement in the short term.

Ⅲ. Capacity and cost considerations: Is yield a bet or a foresight?

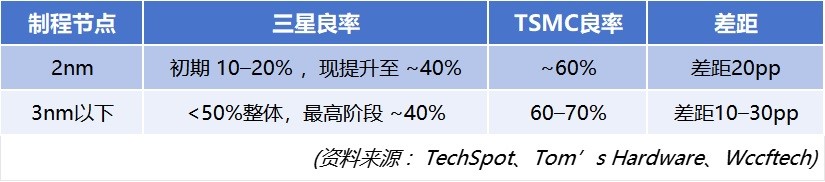

3.1 Yield system comparison: Samsung VS TSMC

Figure: Yield system comparison: Samsung VS TSMC

The yield rate is directly related to the manufacturing cost, and the 10pp gap means that the available chips in every 100 wafers are 20% different, and the corresponding customer cost is increased by nearly 20%. In other words, even if it receives a large subsidy, if 2nm cannot be increased to ≥50%, Samsung will face an extremely embarrassing situation of "technology first, business is difficult to establish".

3.2 Analysis of investment scale: US subsidies + local costs

* CHIPS Act Funding Scale: Samsung Taylor is expected to receive $6.4 billion in subsidies.

* Total investment: The overall investment in the Samsung Taylor project is between $17 billion and $20 billion, covering clean rooms, equipment, packaging and R&D facilities.

* Compared with TSMC's Arizona plan: TSMC's second 2nm production line in Arizona is planned to achieve mass production in 2028, and if Samsung enters the market first in 2026, it will have obvious time and market first-mover advantages.

However, the high construction and operating costs in the United States, coupled with the "must operate" requirement of the subsidy conditions (otherwise there is a risk of recovery of funds), made Samsung bet all on "yield + rapid mass production".

Ⅳ. strategic significance: a multi-dimensional game

4.1 Geo-industrial security

In the context of "chip reshoring", Samsung's 2nm base in the United States is not only a technical layout, but also a signal of political and supply chain security. Mass production of 2nm ahead of TSMC would make Samsung the preferred supplier of advanced chips made in the U.S., increasing its bargaining leverage with domestic customers in the U.S.

4.2 Customer, Ecology and OEM Ecology

According to TrendForce, Samsung has attracted some local AI and emerging chip design factory customers to participate in the 2nm node, but has not yet locked in core orders from large Big Techs such as Apple, NVIDIA, and AMD. If Samsung is unable to build customer trust and stabilize yields by 2026, it will be difficult to achieve its goal of "ecosystem expansion".

With long-term node optimization and local R&D ecosystem, TSMC has a wide range of global customer layouts, even if the production line is located in Taiwan, and the edge advantage cannot be underestimated.

Ⅴ. Risk and game: the key factor of victory or defeat

5.1 Technical Risks

* The key period for yield improvement is at the end of 2025, and if it does not reach 50%, the subsidy may be questioned.

* The production line adjustment window after production is in Q1–Q2 2026, and any delay will affect the "first-mover" positioning.

5.2 Competitive pressure

TSMC's 2nm node is progressing steadily, with the local market still controlling core customers, and the Arizona production line is expected to be mass-produced in the second half of 2025. Intel is also accelerating the development of 18A nodes. Even if Samsung achieves a technological breakthrough, it will face full pressure on its market share.

5.3 Slow ecological construction

After the postponement of the local 1.4nm project in Pyeongtaek due to resource allocation, Samsung can only rely on a single point breakthrough of 2nm in the short term, but node diversification is still important for customer retention and market competition.

Ⅵ. Unique perspective: the "reverse flow strategy" of resources and the political bubble gamble

Samsung's move can be regarded as a typical "resource reversal strategy": in the wave of global resource scarcity and cost investment, high-quality capital and manpower will be concentrated on the 2nm production line in the United States, and technology, politics and capital will be highly bound. However, this is also an extremely high-risk political game: if the technology is not effective, it will put itself in the double dilemma of "the subsidy engine is launched, and the market is marginalized due to the singleness of nodes".

This is a typical "table jumping": gambling yield improvement, gambling subsidy cashing, and betting customer trust. The implicit logic behind this is that "we must take the lead in the competition in the US industry", otherwise even if the technology is realized, it may become a "latecomer resource exhauster".

Ⅶ. Conclusion: The decisive node, success or failure lies in yield and execution

To sum up, Samsung's strategic path is very clear:

1. Bet on the 2nm node and focus on the construction of clean rooms and the introduction of equipment.

2. Abandon the short-term advancement of 1.4nm, and tilt resources towards the United States.

3. Rely on CHIPS Act subsidies to reduce the cost pressure of local factory construction.

4. Expect to win the trust of customers and the market through yield breakthroughs.

Key signals for the future will be:

* The 2nm yield data fluctuates from the end of 2025 to Q1 2026 - from whether it can be sustainably stable ≥50%;

* Stability of mass production in the first three months after the equipment enters the factory - based on customer feedback on trial production;

* Whether subsidies are delayed or withdrawn due to production line lags – how well the U.S. is enforcing them.

If Samsung wins in these three links, it will not only reshape its global foundry status, but also become an indispensable part of the global layout of American chips; On the contrary, it may fall into the foundry dilemma of "the time window has been lost, the subsidy has been withdrawn, and the node difference has been solidified".