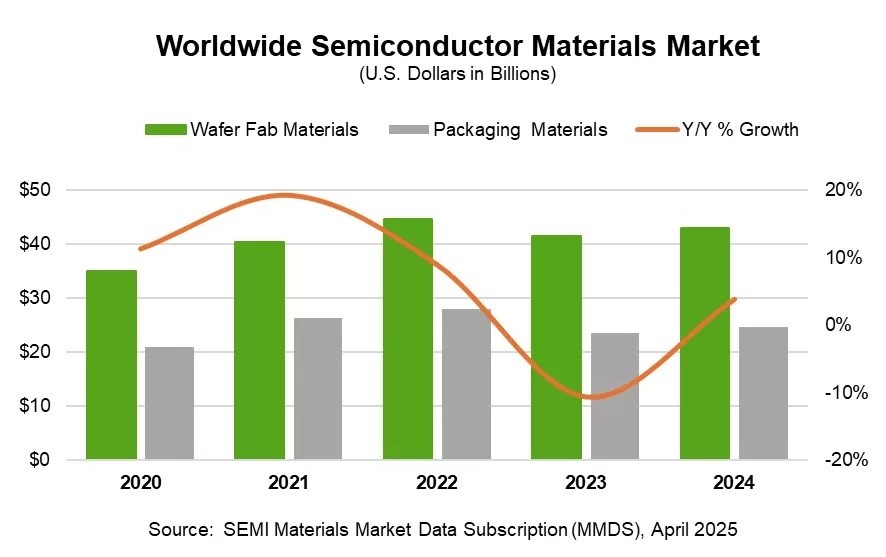

According to the latest data from SEMI, the global semiconductor materials market will reach $67.5 billion in 2024, a year-on-year increase of 3.8%, reflecting the complex situation of the industry. On the one hand, the recovery of the overall semiconductor market and the increase in demand for advanced materials in HPC and HBM manufacturing have injected growth momentum into the materials market, and segments such as CMP chemical mechanical polishing and photoresist have achieved double-digit growth due to the increase in the complexity of advanced manufacturing processes and the number of steps. On the other hand, silicon materials fell by 7.1% in revenue due to weak demand and excess inventory disposal. Geographically, all markets except Japan are showing positive growth. Although the scale of 67.5 billion US dollars has grown, it is still below the high point of 2022, this market is standing at the crossroads of opportunities and challenges, and its future direction affects the pulse of the entire semiconductor industry and even the global scientific and technological development.

image: Global semiconductor materials market

1. Analysis of the reasons for growth

Driven by market recovery: The recovery of the overall semiconductor market is one of the key factors driving the growth of the materials market. In 2024, the global semiconductor industry will usher in a warm spring after a cold winter, showing a significant recovery trend. The World Semiconductor Trade Statistics Organization (WSTS) predicts that the global semiconductor market will grow by 19.1% in 2024, with a market size of $628 billion, and a report by Counterpoint Research also predicts that its total revenue will reach $621 billion, a year-on-year increase of 19%. Behind this is the opportunity brought by the development of artificial intelligence technology, as well as the rise of emerging technologies such as the Internet of Things and 5G, which makes the application demand for semiconductors in various fields continue to rise, which in turn drives the demand for semiconductor materials.

Driven by the demand for advanced processes: The increasing demand for advanced materials in manufacturing fields such as HPC (high-performance computing) and HBM (high-bandwidth memory) has become an important force supporting the growth of materials revenue. With the explosion of generative AI technology, applications have sprung up, and the demand for high-performance computing chips and large-capacity, high-speed memories has surged, and the market demand for photoresists, CMPs, and other materials required to produce these advanced chips has also risen. According to the data, some advanced process-related materials segments will achieve double-digit growth in 2024.

2. Market segment performance

Wafer fabrication materials: Wafer fabrication materials revenue will reach $42.9 billion in 2024, up 3.3% year-over-year. Strong growth was driven by strong performance in segments such as CMP chemical-mechanical polishing, photoresists, and photoresist ancillary materials, driven by increased demand for advanced DRAM, 3DNAND flash memory, and leading-edge logic ICs due to increased demand in terms of complexity and number of process steps.

Encapsulation Materials: Encapsulation materials revenue was $24.6 billion, up 4.7% year-over-year. Driven by the continuous development of emerging applications such as 5G communications and automotive electronics, advanced packaging technologies such as SiP (System-in-Package) and BGA (Ball Grid Array Packaging) are becoming more and more widely used, and the demand for packaging materials is also increasing, which has led to stable growth in the packaging materials market.

3. Regional market fragmentation

Except for Japan, the revenue scale of the semiconductor materials market in all other regions will show positive growth in 2024. On the one hand, this reflects that Japan's competitive landscape in the global semiconductor materials market is relatively special, which may be affected by the comprehensive impact of factors such as domestic industrial structure adjustment, market demand changes and international competition. On the other hand, it also shows that the regional differentiation of the global semiconductor industry is still continuing, and different regions show different development trends according to their own industrial base, policy environment and market demand and other factors.

4. Challenges faced by the industry

Technological bottlenecks to be overcome: Despite the growing trend in the market, the semiconductor industry faces many technical challenges as it moves towards more advanced processes. For example, the limits of lithography technology, the influence of quantum effects, and the problem of chip heat dissipation have brought great challenges to the technological innovation and application of semiconductor materials. Taking lithography as an example, with the continuous shrinking of the manufacturing process, the existing lithography technology is gradually approaching the physical limit, and new lithography technologies and materials need to be developed to meet the needs of higher-end chip manufacturing.

Intensified market competition: The global semiconductor materials market is highly competitive, not only from traditional suppliers, but also from emerging companies, resulting in a fierce competition for market share. Enterprises need to continuously improve their R&D strength, product quality and service level in order to stand out from the competition.

Geopolitical impact: The U.S. government continues to take unreasonable restrictive measures against China, such as revoking some export licenses of Qualcomm and Intel, and raising import tariffs on Chinese-made semiconductor products, which has had an impact on the global semiconductor industry chain and supply chain, and has also brought certain uncertainty to the semiconductor materials market. However, in the long run, this is also expected to promote China and other relevant countries and regions to accelerate the independent and controllable process of the semiconductor industry and accelerate the pace of domestic substitution.

5. Future Trends

The market size is expected to continue to expand: With the continuous development and application of emerging technologies such as artificial intelligence, Internet of Things, 5G, and new energy vehicles, the semiconductor market demand will continue to grow, thereby bringing a broader development space for the semiconductor materials market. It is predicted that the global semiconductor market will reach $635 billion in 2025, a year-on-year increase of 24.7%.

Surge in demand for advanced process materials: In the future, with the advancement of semiconductor manufacturing to more advanced processes, such as the R&D and mass production of 2nm and below processes, the demand for high-performance and high-precision semiconductor materials, such as extreme ultraviolet lithography (EUV) adhesives, advanced CMP materials, and new electronic specialty gases, will continue to increase.

Domestic substitution is accelerating: In China and other countries and regions, the government's policy support for the semiconductor industry is increasing, and the R&D strength and industrial foundation of domestic enterprises are also consolidating.

Overall, the growth of the global semiconductor materials market in 2024 is moderate and complex, with both opportunities and challenges. Despite facing multiple challenges such as technological bottlenecks, market competition and geopolitics, driven by the development of emerging technologies, the market size is expected to continue to expand, and the demand for advanced process materials will continue to rise, and the semiconductor materials market still has broad development prospects in the future.