According to the Global Semiconductor Equipment Market Statistics Report (WWSEMS) released by the International Semiconductor Industry Association (SEMI), global semiconductor equipment shipments in the third quarter of 2024 increased by 19% year-on-year to $30.38 billion, while increasing by 13% quarter-on-quarter. Behind this strong growth is the continued global demand for semiconductor manufacturing equipment, which is largely driven by the rapid development of artificial intelligence technology and investment in the production of mature technologies.

Artificial intelligence drives investment in the semiconductor industry

Ajit Manocha, President and CEO of SEMI, noted that the growth of the global semiconductor equipment market in the third quarter of 2024 was driven by global investments in supporting the adoption of artificial intelligence and the production of mature technologies. The widespread application of AI technology, especially in areas such as data centers, autonomous driving, smart manufacturing, and the Internet of Things, is driving the growing demand for high-efficiency semiconductor devices.

The rapid development of AI has put forward higher requirements for the semiconductor industry. As the demand for computing power and chip performance for AI applications continues to escalate, semiconductor equipment manufacturers are investing more to upgrade manufacturing technology to meet the higher requirements of next-generation AI applications for chip performance. This trend is not only reflected in the field of chip design, but also drives advancements in manufacturing equipment, materials, and processes, becoming one of the major drivers of growth in the global semiconductor equipment market.

Global Market Investment Differentiation: North America and China dominate the market

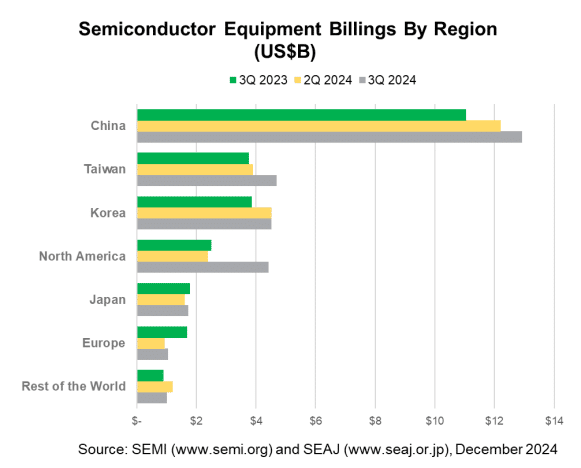

The SEMI report also notes that semiconductor equipment investment shows different growth trends in different regions. North America saw the largest year-over-year growth, while China continued to lead the way in equipment spending, further highlighting regional differences in the global semiconductor manufacturing landscape.

Figure: Global semiconductor equipment capital expenditures by region

North American Market: Growth is strong

The semiconductor equipment market in North America showed the largest growth. This growth may be closely related to the U.S. push for semiconductor manufacturing autonomy. In recent years, the United States has encouraged the development of the domestic semiconductor manufacturing industry through policies such as the CHIPS Act, providing funding and policy support. With the sharp rise in demand for AI and high-performance computing, the demand for advanced semiconductor manufacturing technologies in North America is also increasing, which is further stimulating the growth of the semiconductor equipment market.

China Market: Spending Leadership

China continues to lead the global semiconductor equipment market in spending. China is committed to building a more independent semiconductor industry chain, especially in the face of external technological constraints, China has increased investment in local semiconductor manufacturing equipment and technology. As China accelerates the development of 5G, AI and new energy vehicles, the domestic demand for efficient and advanced semiconductor equipment will continue to remain strong.

The restructuring of the global semiconductor supply chain and the enhancement of the manufacturing ecosystem

The rapid development of the global semiconductor market also means that the semiconductor manufacturing ecosystem continues to strengthen. As the world ramps up investment in the semiconductor industry, regions are looking to upgrade their chip manufacturing capabilities to stay ahead of the global competition. In addition to traditional semiconductor powerhouses (such as the United States, South Korea, Japan and Taiwan, some emerging economies are also actively promoting the development of local semiconductor industries and striving to reduce their dependence on foreign countries.

In addition, with geopolitical changes and the reconfiguration of global supply chains, all aspects of the semiconductor industry are undergoing adjustments. Many countries have strengthened policy support and provided investment incentives to attract semiconductor manufacturers to relocate production lines to their home countries or expand existing production capacity. This trend is not only driving the enhancement of local manufacturing capacity, but also bringing new investment opportunities to the global semiconductor equipment market.

Looking to the future: The semiconductor equipment market continues to grow

With the continuous evolution of artificial intelligence technology and the emphasis on independent semiconductor production capacity in countries around the world, the semiconductor equipment market will continue to maintain strong growth in the coming years. The shipment growth trend in the third quarter of 2024 shows that the global demand for semiconductor equipment is still on an upward trajectory, especially driven by AI, big data and 5G technology, and the investment enthusiasm in the semiconductor industry will continue to be high.

Although most of the current market demand is concentrated in fields such as AI and high-performance computing, with the popularization of global electronic products and the acceleration of automation, the demand for semiconductor equipment will be further diversified in the future, driving equipment manufacturers to continue to innovate and improve product performance and production efficiency.