According to the latest analysis of the Critical Materials Report released by TECHCET, the global semiconductor precursor market is ushering in a period of stable growth and is expected to achieve a compound annual growth rate (CAGR) of 10.4% through 2029. This trend is mainly due to the development of advanced logic nodes below 3nm, the surge in demand for artificial intelligence and high-performance computing (HPC), and the expansion of fabs in the United States, Europe and Asia.

Market recovery momentum: Technology iteration is driving demand recovery

After a brief downturn in 2023, the semiconductor precursor market rebounded rapidly in 2024, reaching a market size of $1.7 billion. The recovery was mainly driven by the mass production of 2nm and 3nm process technologies and the large-scale adoption of GAA-FET (Surround Gate Transistor) structures. At the same time, the partial recovery in the start-up of NAND and DRAM production lines has also injected new vitality into the market.

Looking at the entire semiconductor materials field, the total market size will reach $66.3 billion in 2024. In the next five years, the maturity of dry resist technology, innovative solutions such as molybdenum metallization, and low dielectric constant (low-k) materials will further boost the demand for upstream precursors.

Technological change is accelerating the expansion of the precursor market

Semiconductor precursors are indispensable key materials in thin film deposition processes such as ALD/CVD, and are widely used in the fabrication of transistor gates, interconnected metal layers, and memory structures. Currently, the growth of the precursor market is primarily driven by the following factors:

1. The evolution of advanced logic chips to 2nm and below nodes puts forward higher requirements for deposition accuracy, purity and selectivity.

2. The mainstreaming of GAA structures has brought about the need for new material combinations and precursor molecular structures.

3. The increasing complexity of DRAM and 3D NAND architectures has led to the continuous increase in the use of high-dielectric and metal precursors.

4. System-in-package (SiP) and heterogeneous integration are developing, increasing the reliance on specialty materials.

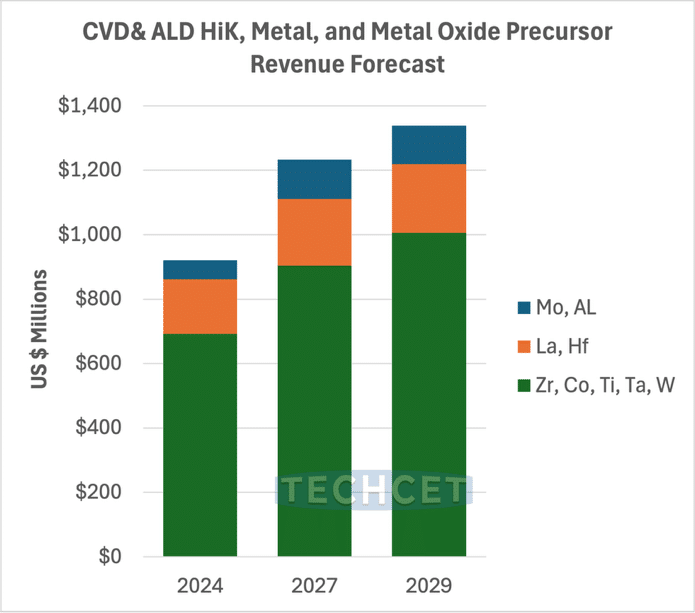

Image: TECHCET forecasts semiconductor ALD/CVD precursor market outlook and growth

Geopolitical risks exacerbate supply chain vulnerabilities

Despite the huge growth potential of the market, the global precursor industry chain is still facing severe challenges, especially the raw material supply risks brought about by geopolitics. For example:

1. The United States imposed tariffs on Chinese tungsten products, which had an impact on the global tungsten supply chain;

2. China's announcement in December 2024 to restrict germanium exports has further increased uncertainty about semiconductor material procurement.

3. Critical materials such as cobalt, tungsten and rare earths are highly dependent on high-risk regions such as China and the Democratic Republic of the Congo, exacerbating supply chain vulnerabilities.

In order to reduce dependence on a single country, the United States, Europe, Japan and other places have launched "regionalization strategies" to promote the establishment of local material supply systems. Wafer manufacturing giants, including Intel, TSMC, and Samsung, are also deploying production capacity around the world to strengthen the supply chain's ability to resist risks.

Sustainability is the new standard for material procurement

Driven by environmental protection policies and social responsibility, sustainable procurement and green manufacturing have become a new trend in the development of the industry. Lita Shon-Roy, President of TECHCET, said: "Suppliers are under pressure from downstream customers to invest more in environmental, safety and health (EHS) compliance, green chemical process development, and material recycling capabilities.”

However, there are still challenges in achieving true recycling, especially when dealing with high-temperature process residues and radioactive and highly corrosive by-products.

Conclusion: Embracing growth, but also dealing with challenges

The global semiconductor precursor market is in a new stage from "technology-driven" to "technology+strategic synergy". On the one hand, AI, HPC, and advanced manufacturing processes have brought unprecedented market dividends. On the other hand, supply chain security, sustainable development, and environmental protection laws and regulations have become thresholds that must be crossed in the future. For material companies, only by taking a three-pronged approach to innovation, compliance and global layout can they seize the opportunity in this key track and win the future.