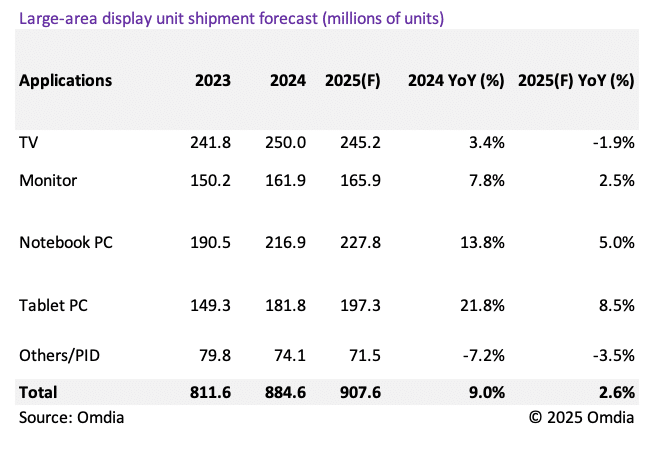

According to Omdia's latest Large Display Market Tracker, shipments of large displays of 9 inches and above are still expected to grow by 2.6% year-on-year, despite multiple challenges. However, this growth rate has slowed significantly compared to 2024, reflecting the continued pressure on the industry due to external factors such as global economic uncertainty and U.S. trade policies.

Different applications, uneven heat and cold

From the perspective of subdivided applications, the development rhythm of various products is intensifying. The traditional pillar TV market is facing downward pressure, with shipments of LCD TV display units expected to decline by 2.2% year-on-year in 2025. The reasons for this situation are not only the adjustment of upstream supply, but also the impact of corporate strategy adjustment. For example, Sharp closed its 10th generation LCD TV panel production line in the third quarter of 2024, directly cutting production capacity. At the same time, China's major panel manufacturers have chosen to adopt a more conservative shipping strategy in the face of price fluctuations to stabilize prices and control risks.

The "Other/PID" category is more sensitive, with shipments expected to decline by 3.5%. This kind of product is widely used in public information display, commercial signage and other scenarios, and is easily affected by changes in the overall economic environment. In the event of an economic slowdown or tighter business investment, demand in this market can shrink rapidly.

In contrast, the display and tablet market has shown some resilience and growth. It is expected that display shipments will reach 165.9 million units in 2025, a year-on-year increase of 2.5%; Tablet shipments are expected to exceed 197 million units, an increase of 8.5%. Behind this trend is the continuous demand for mobile office, remote learning and home entertainment, as well as the continuous improvement of the functions and experience of terminal devices.

Differentiation of technical routes: LCD is stable and changing, and OLED kinetic energy is strong

In terms of display technology, the development path of LCD and OLED has gradually widened the gap. As the mainstream technology, LCD still maintains a steady growth trend. It is expected that in 2025, the shipment volume of large-size LCD units will increase by 2.0% year-on-year, and the shipment area will increase by 3.9% year-on-year. However, considering the early release of some panel purchases and the uncertainty of the economic trend in the second half of 2025, manufacturers are more conservative in scheduling production, focusing more on the growth of "area" rather than "quantity" to improve profitability.

OLED continues to show strong growth momentum. Although its growth rate has slowed from 2024, large-size OLED shipments are still expected to increase by 20.4% and the shipment area is expected to increase by 12.9% in 2025. Among them, laptops and displays have become the key drivers of OLED growth. According to the data, the shipments of Chinese manufacturers in the field of OLED tablets are expected to decline by 9.2%, mainly limited by the high price threshold; However, in the field of OLED notebooks, shipments from Chinese manufacturers are expected to increase by 5.4%. What's more striking is that global OLED notebook shipments are expected to grow by 47.0%, becoming a bright spot in the evolution of display technology.

In addition, thanks to the active expansion of Korean brands in the OLED TV field, its shipments are also expected to increase in 2025. South Korean OLED manufacturers will continue to advance their technology and marketing strategies in the display and notebook markets, which are expected to achieve double-digit growth.

Figure: Large-format display shipment forecast

Structural changes behind revenue growth

From a revenue perspective, the total revenue of the large-size display market is expected to reach $72.7 billion in 2025, a year-on-year increase of 3.5%. This is a significant slowdown compared to the strong growth of 14.8% in 2024. The reason for the rapid growth in 2024 is partly due to the increase in revenue driven by the increase in the price of LCD TV panels. However, by 2025, the growth rate of shipments will be difficult to match the previous level, and the market focus is shifting from "quantity" to "quality".

It is worth mentioning that despite the slowdown in shipment growth, the shipment area is expected to increase by 4.3% year-on-year, which exceeds the increase in shipments, indicating that the trend of large size is still clear. Especially in the field of terminals such as TVs, the screen is getting bigger and bigger, which not only improves the user experience, but also brings higher unit prices and profit margins to manufacturers.

Respond to challenges and find growth points

On the whole, the large-size display market in 2025 is still at the crossroads of challenges and opportunities. On the one hand, geopolitical and economic uncertainties have put continuous pressure on the industrial chain, and companies need to find a balance between costs, inventories and prices. On the other hand, emerging application scenarios and technology upgrades have injected new momentum into the market.

In the future, if panel manufacturers want to break through in this complex environment, they need to grasp the market rhythm more accurately and dynamically adjust the product structure and technical route. At the application level, priority can be given to areas with strong growth, such as notebook computers, OLED and high-end displays; At the strategic level, it is necessary to strengthen supply chain flexibility to cope with volatile global markets.