After learning about intelligent driving components and three types of radar, let's finally talk about cameras. The in-vehicle camera market has grown rapidly in recent years with the development of intelligent and autonomous driving technologies. According to 2023 data, the global automotive camera market has shipped a total of 218 million units, which is expected to grow to 402 million units by 2028. In terms of market size, it grew from $8.54 billion in 2017 to $15.71 billion in 2022, with a compound annual growth rate of 13.0%.

In China, shipments of automotive cameras increased from 16.9 million units in 2017 to 61.31 million units in 2022, with a compound annual growth rate of 26.2%. The market size is expected to reach 14.403 billion yuan. The Chinese market occupies an important position in the global automotive camera market, with a market size of US$2.64 billion in the first half of 2022, accounting for 40.3% of the global market.

Looking at the 100 billion market of on-board cameras from a long perspective, the arms race for autonomous driving in the near future begins

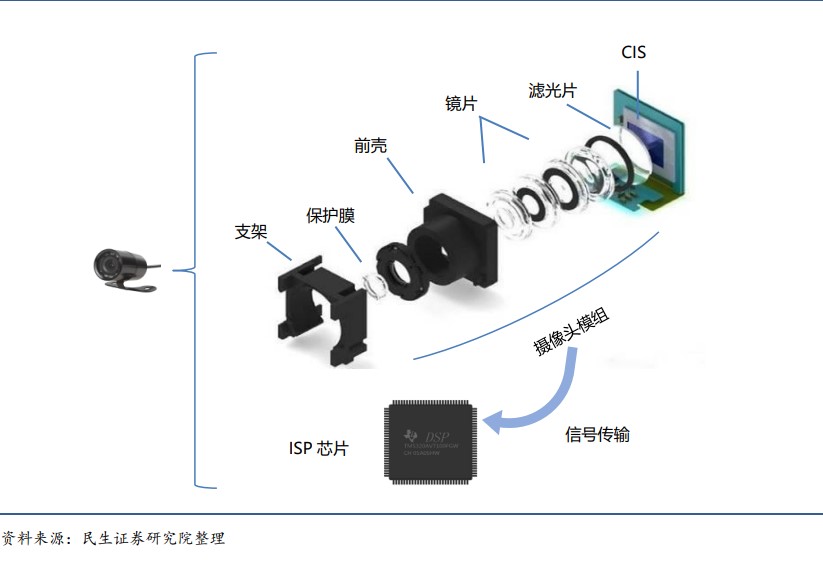

How in-vehicle cameras work: In-vehicle cameras are a key component in advanced driver assistance systems (ADAS) that use optical lenses to focus light and project objects in the field of view onto an image sensor, which then converts the optical signal into an electrical signal. This electrical signal is then converted into a digital image signal through analog-to-digital conversion (A/D), which is then processed by a digital signal processing chip (DSP) to transmit the processed image to the display screen for display.

Figure: Schematic diagram of automotive camera parts

Vehicle cameras can be divided into front, surround, rear, side, and built-in cameras according to the installation location. Each camera has its own specific angle of view and detection distance and is used for different driver assistance functions such as Forward Collision Warning, Lane Departure Warning, Automatic High Beam, 360-degree surround view, blind spot monitoring and driver status monitoring.

For example, a front-view camera is typically mounted on the front windshield for object recognition and ranging and velocity, while a surround-view camera is mounted around the vehicle to provide a panoramic surround view. The rearview camera is generally mounted on the trunk and is used for parking assistance. Side-view cameras are mounted on both sides of the vehicle to detect vehicles and bicycles on the side, while built-in cameras are used to monitor the driver's status and provide fatigue warnings.

At present, the functions of in-vehicle cameras require the following performance: In-vehicle cameras often need to have night vision capabilities, which can suppress noise during low-light photography and still perform well in low-light conditions. The horizontal angle of view is expanded to 25°~135°, and at least 5 lenses are used to achieve wide angles and high resolution around the image.

Figure: Safety requirements for in-vehicle cameras

According to Minsheng Securities, the vehicle camera industry will follow the law of mobile phone camera innovation, and benefit from the triple factors of increasing the penetration rate of intelligent connected vehicles + increasing the number of single vehicle configurations + catalyzing ASP improvement in performance upgrades, and the vehicle camera market will continue to boom. According to the forecast of Minsheng Securities, by 2030, the global vehicle camera market will reach 100 billion yuan, and the compound growth rate in 10 years can reach more than 20%. According to the "Intelligent Connected Vehicle Technology Roadmap 2.0", from 2020 to 2050, the sales of L2-L3 intelligent networked vehicles accounted for more than 50% of the total vehicle sales in that year, and L4 intelligent networked vehicles began to enter the market. By 2026-2030, L2-L3 intelligent networked vehicles will account for more than 70% of sales, and L4 vehicles will be widely used on high-speed roads and large-scale applications on some urban roads. By 2031-2035, all kinds of connected vehicles and high-speed autonomous vehicles will be widely operated.

Figure: Automotive camera market size

The technology of automotive cameras is also constantly innovating, and the performance of the image sensor as the core component directly affects the imaging quality of the camera. At present, the image sensors on the market are mainly divided into two types: CCD and CMOS, among which CMOS image sensors are widely used in the field of vehicle cameras due to their advantages of low cost and high efficiency.

The competitive landscape of the global automotive camera market is mainly dominated by several well-known companies, including Bosch, Continental, Denso, and others. Through technological innovation and scale effect, these enterprises have great advantages in product quality, performance and cost.

In addition, the development trend of in-vehicle cameras, including the increase in the number of vehicles installed, the high-definition of cameras, and the simplification of hardware and cost reduction driven by centralized architecture, are helping to increase the penetration rate of in-vehicle cameras.

For more info:

The Road to Multi-sensor Fusion Begins (1)

The Road to Multi-sensor Fusion Begins (2)

The Road to Multi-sensor Fusion Begins (3)